Merit and P&S Non-Exempt Employee Payslip |

|

|

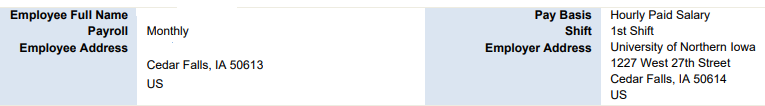

All employees access their Payslip online through UNI Emloyee Self Service. All Faculty and Staff receive a monthly payslip. To view your Payslip, visit View Your Payslip for instructions. Top section of Payslip - Displays Employee Full Name and Employee Address, Payroll Type (Monthly), Pay Basis (Hourly or Hourly Paid Salary), Shift, and Employer Address.

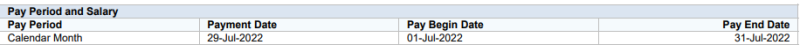

Pay Period and Salary - Displays Pay Period (Calendar Month), Payment Date, Pay Begin Date and Pay End Date indicate the month Merit and P&S Non-Exempt salaried employees are being paid their salary. Employees should refer to the Payroll Periods and Paydays to view pay periods which determine a Merit and P&S hourly employee's pay and Merit and P&S Non-Exempt salary employee's pay for overtime, shift pay, lead pay, off duty and any other miscellaneous pay type.

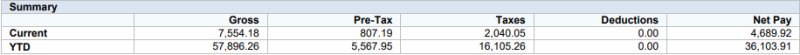

Summary - Displays Current and YTD for Gross Earnings, Pre-Tax items, Taxes, Deductions, and Net Pay.

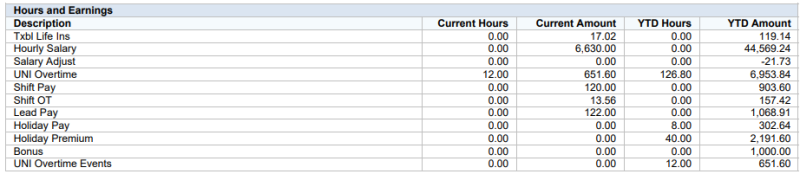

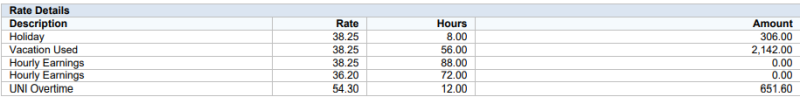

Hours and Earnings - Displays a description of the earnings such as Hourly Salary, Hourly Earnings, Overtime, Shift Pay, Taxable Life Insurance, etc. The number of Current Hours and Current Amount are displayed. The number of YTD Hours and YTD Amount are displayed. Rate Details - Displays description of the rate such as Hourly Earnings, Vacation Used, Holiday, Overtime plus the rate per hour, the number of total hours, and the dollar amount.

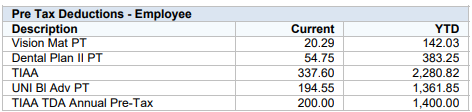

Pre Tax Deductions - Employee - Displays Current and YTD pre tax deductions descriptions and amounts for the employee.

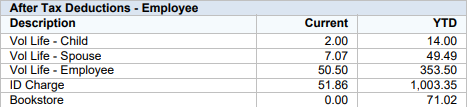

After Tax Deductions - Employee - Displays Current and YTD after tax deductions descriptions and amounts for the employee.

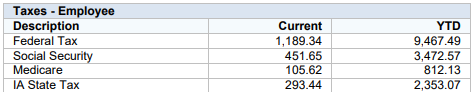

Taxes - Employee - Displays Current and YTD tax deductions for the emloyee.

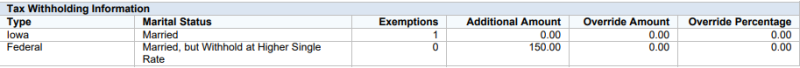

Tax Withholding Information - Displays the Type of Tax (federal or state), Marital Status, Exemptions, and any other monies withheld for taxes.

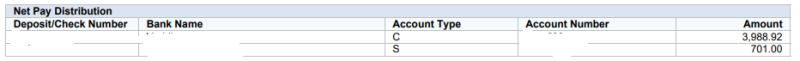

Net Pay Distribution - Displays the Deposit/Check Number, Bank Name(s), Account Type, Partial Account Number, and the Net Amount paid.

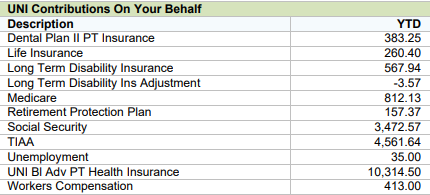

UNI Contributions On Your Behalf - Displays the Description and YTD amount UNI has contributed on your behalf.

|

|

| If you have any questions about Merit and P&S Non-Exempt Employee Payslip, please contact Business Operations at 319-273-2162 or email payroll@uni.edu. | |